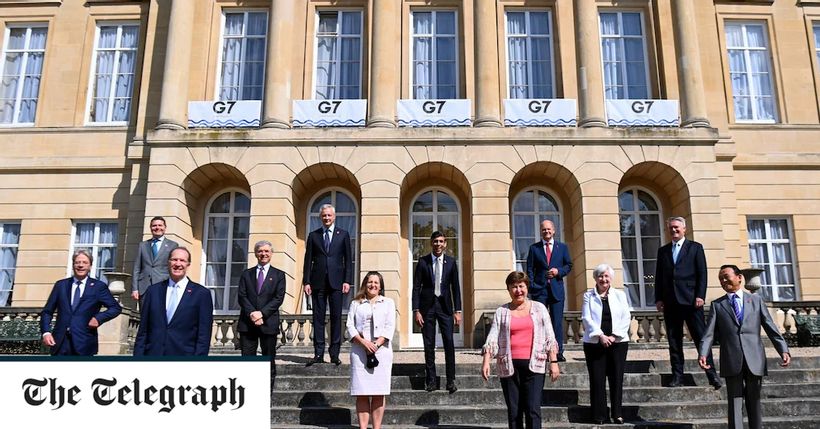

It is therefore no bad thing that the proposed new global minimum tax rate of 15% is too low to make a meaningful difference. Within the OECD, only Ireland (12.5%), Chile (10%) and Hungary (9%) currently have a lower rate than this.

The plan to redistribute tax revenues on the basis of where sales are made does not look like a game-changer either. In particular, it will only apply to a small share of profits (as low as 20%) and then only to those exceeding a 10% margin.

This threshold should be…