Key Takeaways

- The “Costanza strategy,” buying stocks at market highs when they are most expensive, has delivered solid long-term returns.

- The lesson is that the amount of time in the market matters more than perfect timing.

- We also found that regular contributions to your investment account can outperform putting a lump sum into the market at a bad time.

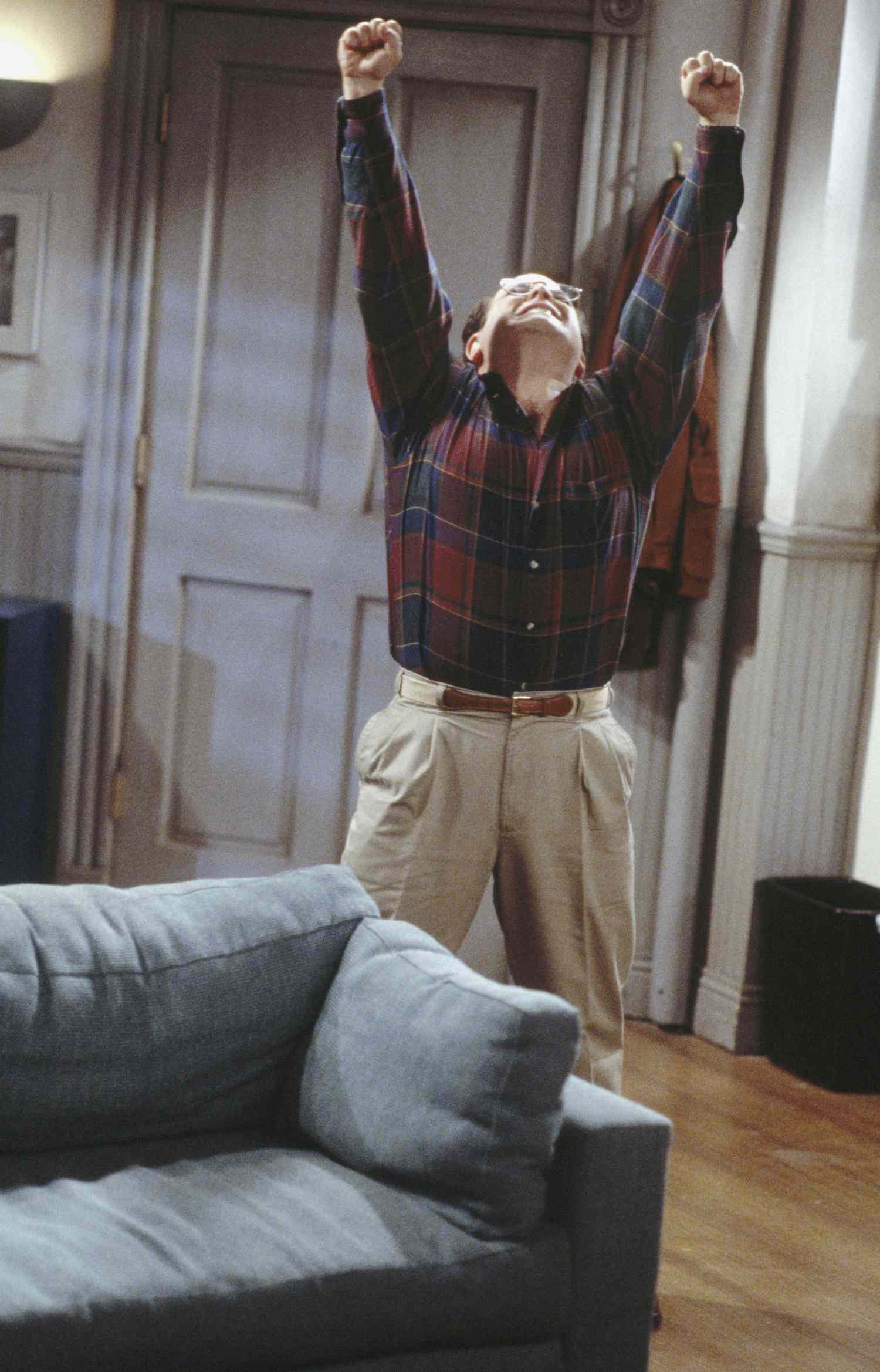

“Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong,” actor Jason Alexander says as the character George Costanza in the classic 1994 Seinfeld episode “The Opposite”—a feeling many investors know all too well. Buying high, selling low, panicking at the wrong moment—it can feel like we are often doing the opposite of…