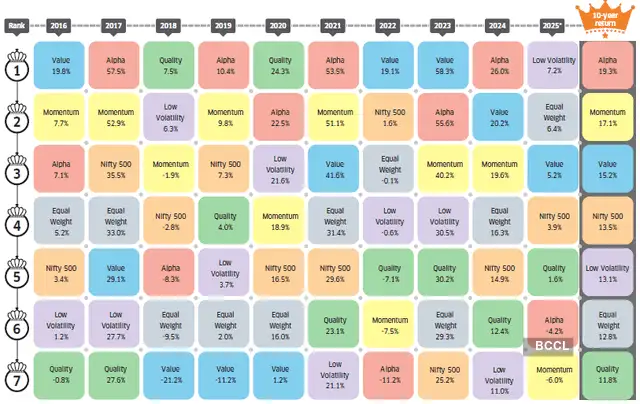

In 2025, the Low Volatility strategy emerged as the top performer, driven by market turbulence, domestic demand challenges, and global macroeconomic uncertainty. Investors favoured stability, making low-risk stocks attractive. The Equal Weight strategy followed closely, benefiting from reduced concentration risk and balanced exposure across market segments, especially mid- and small-caps.

Value investing remained resilient, supported by India’s strong economic growth outlook. However, its returns were limited due to sectoral rotation, and the lack of growth catalysts in traditional industries such as utilities.

The Quality strategy, despite its defensive nature, failed to make a significant impact in 2025….