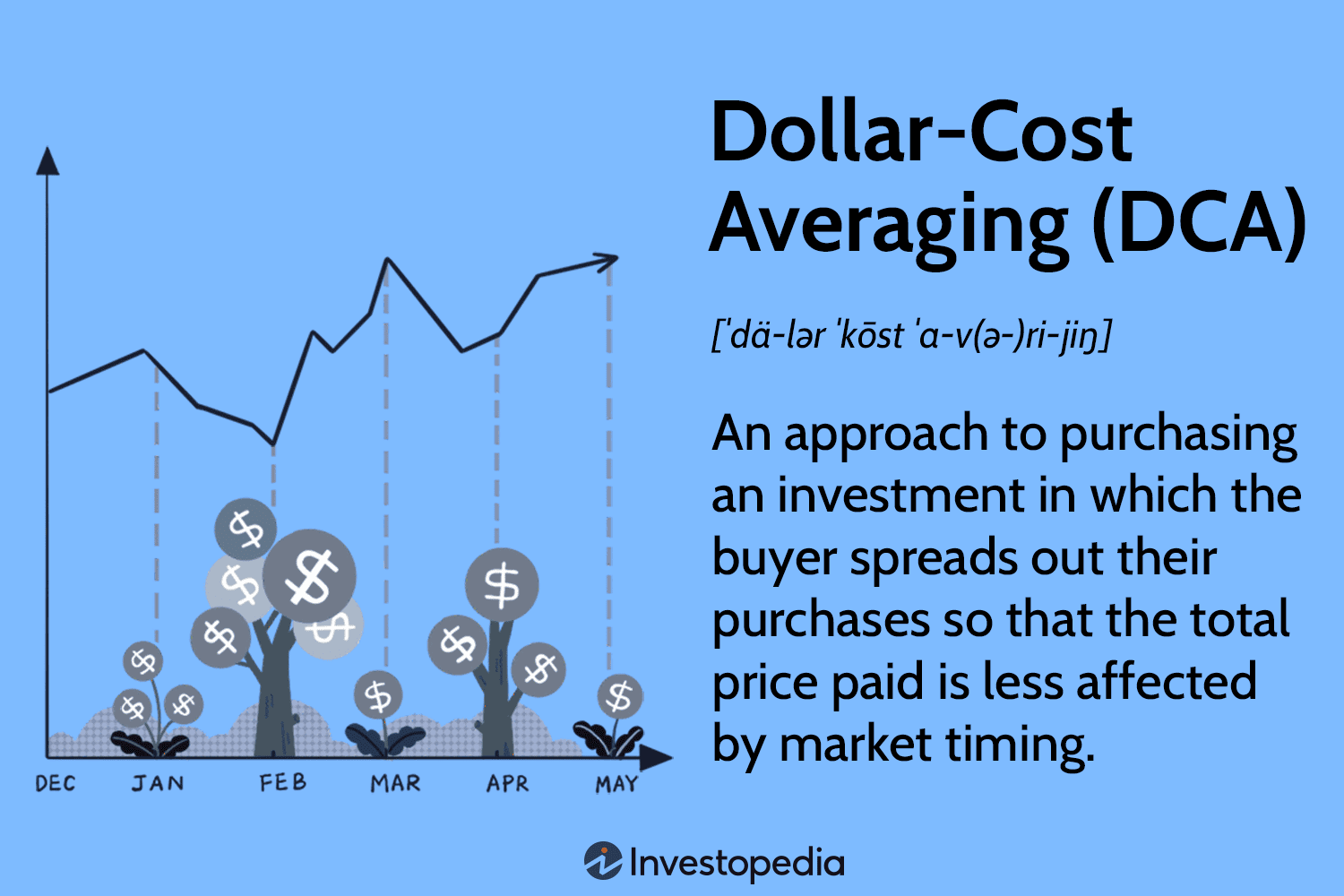

What Is Dollar-Cost Averaging (DCA)?

Investing can be challenging, as even experienced investors who try to time the market can come up short. Dollar-cost averaging (DCA) is an investment strategy that removes the uncertainty of market timing by adhering to a fixed investment schedule. It also supports an investor’s effort to invest regularly.

DCA involves investing the same amount of money in a target security at regular intervals over a certain period, regardless of price. By using DCA, investors may lower their average cost per share and reduce the impact of volatility on their portfolios. In effect, this strategy eliminates the effort required when attempting to time the market to buy at the best prices.