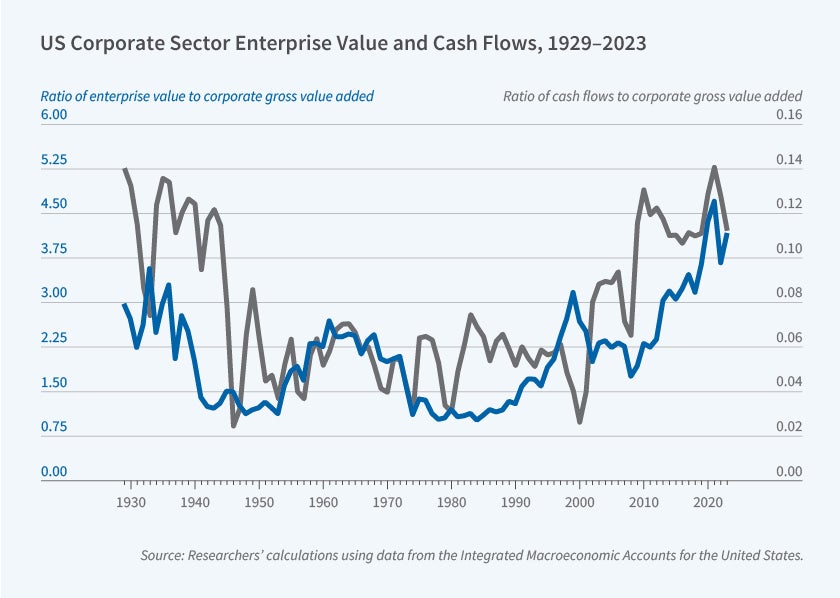

One leading view in finance is that the high volatility of the stock market valuations of US corporations is driven by large fluctuations in expected returns. However, if expected returns are so volatile, why is the capital stock of the same US corporations relatively stable? In Reconciling Macroeconomics and Finance for the US Corporate Sector: 1929 to Present (NBER Working Paper 33459), researchers Andrew Atkeson, Jonathan Heathcote, and Fabrizio Perri seek to reconcile these seemingly discordant observations.

Fluctuations in expected cash flows, not expected returns, are the primary drivers of volatility in US corporate valuations.

The researchers analyze the Integrated Macroeconomic Accounts (IMA) for the United…