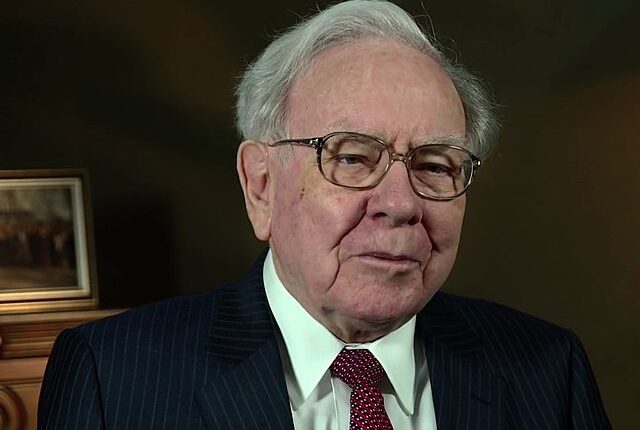

Warren Buffett’s value investing strategy holds timeless appeal for today’s investors

Warren Buffett, the legendary “Oracle of Omaha,” has become synonymous with disciplined, thoughtful investing. In a world filled with fast-moving trends, hype-driven stocks and constant market noise, Buffett’s approach offers a proven alternative: value investing combined with a patient buy-and-hold strategy.

Earlier this month Buffett, 94, announced he would step down as the CEO of Berkshire Hathaway, the holding company he has run for 60 years, at the end of 2025. His retirement has spurred fresh looks at his value investing strategies.

Value investing is about identifying companies that are trading below their intrinsic worth. It’s like finding a high-quality product on sale. Buffett looks for businesses with strong…