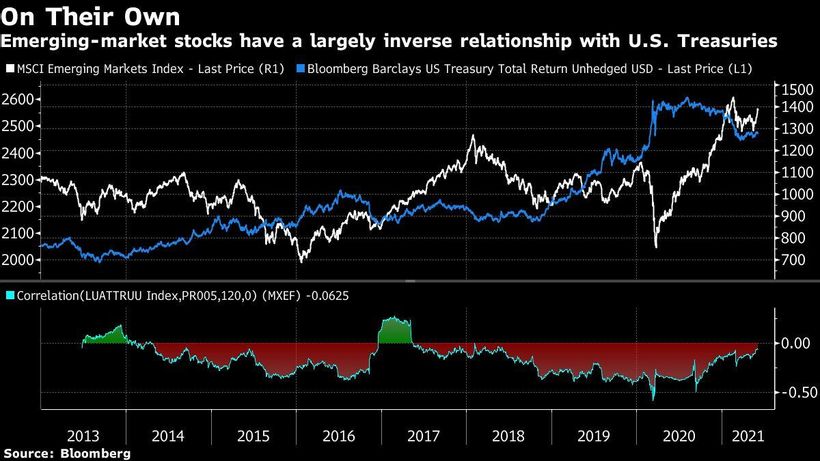

(Bloomberg) — The debate about when the Federal Reserve will start scaling back bond purchases is driving some investors to emerging-market assets less exposed to a potential surge in U.S. yields.

William Blair Investment Management and Fidelity International are bulking up on high-yield or frontier bonds that are less sensitive to U.S. interest rates. Meantime, Bank of America Corp. is recommending that investors scoop up emerging-market euro-denominated bonds, predicting yields in the common…