Subdued Growth No Barrier To YKT Corporation’s (TSE:2693) Price

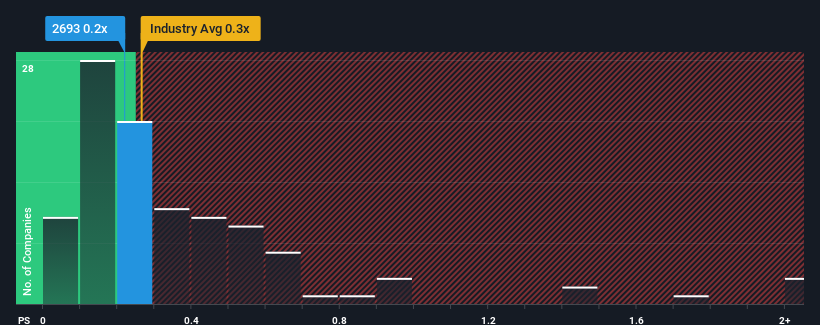

There wouldn’t be many who think YKT Corporation’s (TSE:2693) price-to-sales (or “P/S”) ratio of 0.2x is worth a mention when the median P/S for the Trade Distributors industry in Japan is similar at about 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

We’ve discovered 4 warning signs about YKT. View them for free.

Check out our latest analysis for YKT

How YKT Has Been Performing

For instance, YKT’s receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep…