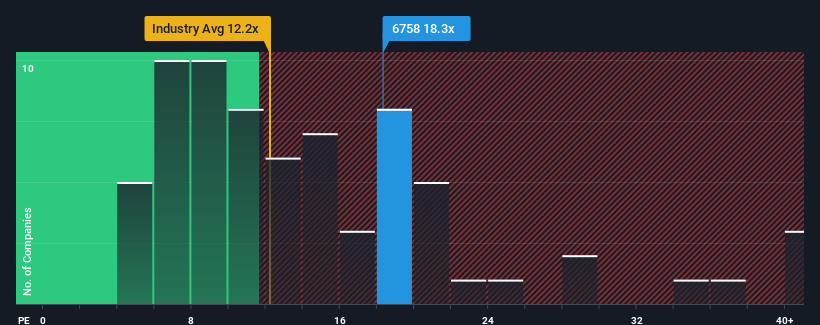

When close to half the companies in Japan have price-to-earnings ratios (or “P/E’s”) below 13x, you may consider Sony Group Corporation (TSE:6758) as a stock to potentially avoid with its 18.3x P/E ratio. Although, it’s not wise to just take the P/E at face value as there may be an explanation why it’s as high as it is.

Sony Group certainly has been doing a good job lately as it’s been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You’d really hope so, otherwise you’re paying a pretty hefty price for no particular reason.

View our latest analysis for Sony Group

…