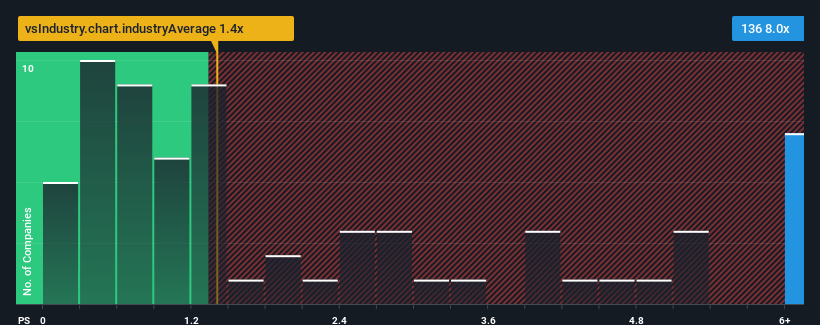

When you see that almost half of the companies in the Entertainment industry in Hong Kong have price-to-sales ratios (or “P/S”) below 1.4x, China Ruyi Holdings Limited (HKG:136) looks to be giving off strong sell signals with its 8x P/S ratio. Although, it’s not wise to just take the P/S at face value as there may be an explanation why it’s so lofty.

We’ve discovered 1 warning sign about China Ruyi Holdings. View them for free.

Check out our latest analysis for China Ruyi Holdings

How China Ruyi Holdings Has Been Performing

China Ruyi Holdings could be doing better as it’s been growing revenue less than most other companies lately. It might be that many expect the…