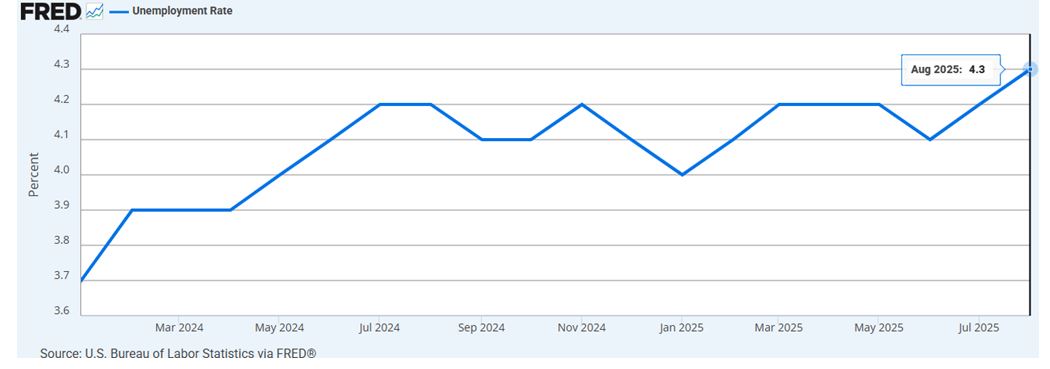

The U.S. labor market is showing clear signs of weakness. In August 2025, the economy generated only 22,000 nonfarm jobs, far below the expected 75,000, pushing the unemployment rate up to 4.3%, the highest level since 2021. This comes on top of the largest historical job revision in decades, with 911,000 positions erased from the statistics between 2024 and 2025.

This cooling of the labor market reinforces expectations that the Federal Reserve (Fed) will accelerate its interest rate cut cycle, with the possibility of further adjustments in the coming months.

For asset managers, this environment combines risks and opportunities, according to FlexFunds. On the one hand, traditional assets—equities and fixed income—may face limited…