Sandisk’s red-hot stock market rally seems here to stay thanks to the favorable dynamics of the flash storage market.

Sandisk (SNDK 0.72%) has set the stock market on fire in 2026, rising an incredible 166% as of this writing, thanks to red-hot demand for the company’s flash memory storage solutions used in a variety of applications.

A big reason investors have been buying this semiconductor stock hand over fist of late is that it trades at an incredibly cheap valuation. Importantly, Sandisk’s earnings growth potential and the valuation make it clear that it can sustain its momentum in 2026.

Let’s take a closer look at the potential upside investors can expect from Sandisk by the end of the year.

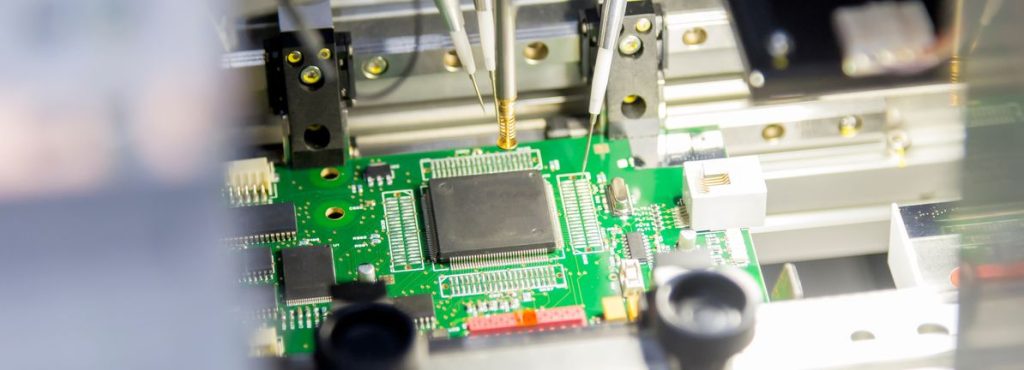

Image source: Getty Images.