Key points:

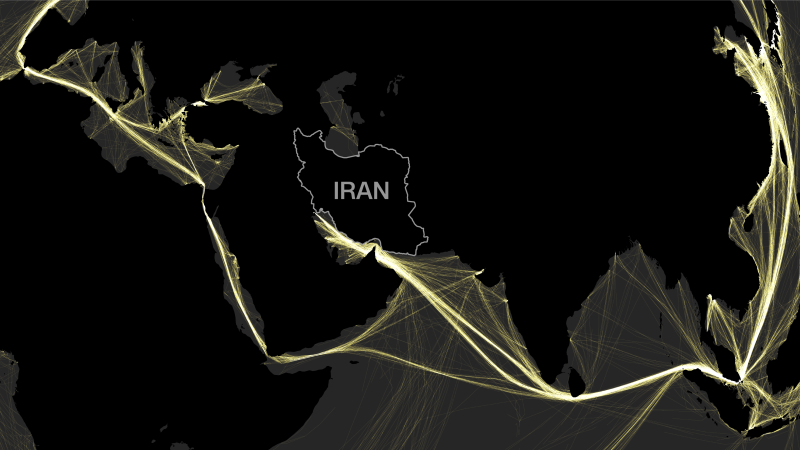

- Over the last five years, Saxo’s client data shows investors who used more than one product type have tended to be more profitable than those using only one.

- A broader toolkit may help by reducing hidden concentration, improving decision-making in drawdowns, and providing more than one way for a portfolio to perform across market regimes.

- Getting started doesn’t require a portfolio overhaul. One small step beyond stocks (ETF, bonds, commodities, or simple collateralised options) can be a practical first move.

An interesting insight

Markets don’t reward the same exposures every quarter. Multi-asset investing is less about chasing returns and more about building a portfolio that can behave through different regimes,…