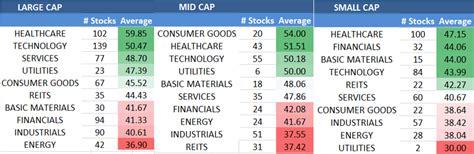

Is Apple Hospitality REIT (APLE) Offering Value After Recent Share Price Weakness?

- If you have been wondering whether Apple Hospitality REIT is attractively priced or just a value trap, this breakdown is designed to help you size up the stock in a clear, practical way.

- The share price recently closed at US$12.19, with returns of 1.1% year to date but a 13.8% decline over the last year and a 24.5% gain over five years, which gives a mixed picture of how the market has been treating the REIT.

- Recent headlines around U.S. hotels and travel, including ongoing discussions about demand levels in key markets and investor interest in income oriented real estate, frame how investors are looking at hospitality focused REITs such as Apple Hospitality. These themes help explain why the stock has seen relatively modest 30 day…

Source link