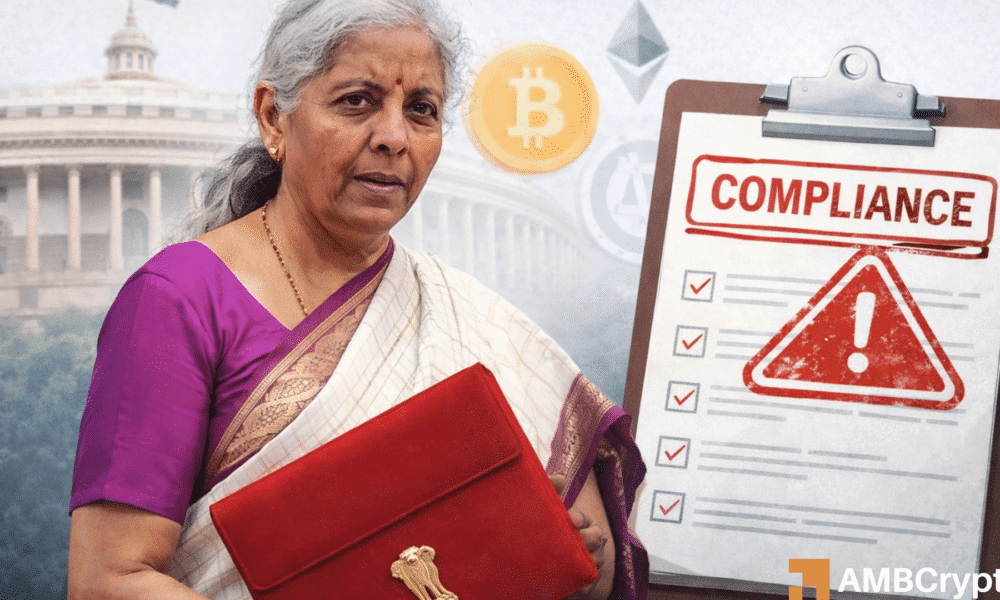

India’s Union Budget 2026 has introduced a new penalty framework to enforce crypto-asset transaction reporting.

In simple words, the new budget tightens oversight on exchanges and intermediaries even as the country’s controversial crypto tax regime remains unchanged.

The Finance Bill proposed penalties to enforce reporting obligations under Section 509 of the Income-tax Act, 2025.

Those obligations include requiring “prescribed reporting entities” to submit statements detailing crypto-asset transactions to the tax department. The changes will take effect from the 1st of April, 2026.

What the new penalty framework looks like

Under the new framework, entities that fail to furnish the required statement will face a…