How This Options Strategy Works, With Examples

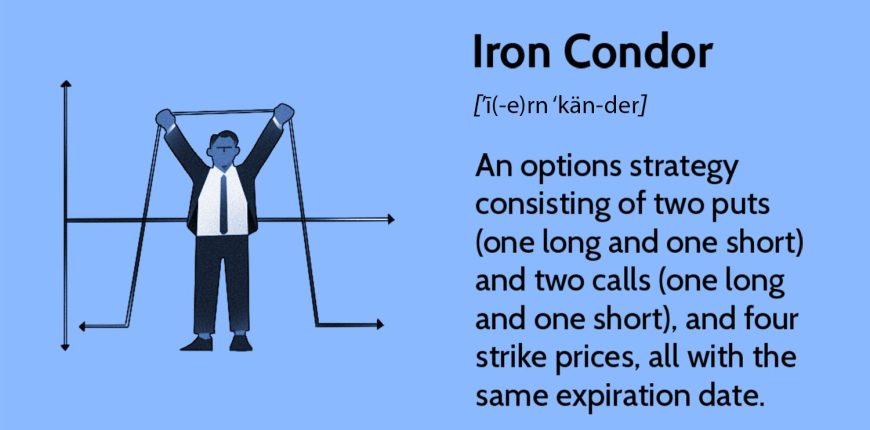

A more sophisticated options strategy, the iron condor is a risk-defined way to profit from low volatility by selling an out-of-the-money (OTM) put spread and an OTM call spread, collecting a net credit upfront.

As long as the stock or exchange-traded fund (ETF) stays within a set range, the sold options expire worthless, allowing traders to keep the premium while benefiting from time decay. While profits are capped, so are losses, making it a high-probability, structured strategy for traders looking for steady income without betting on big market moves.