How They Work and How to Use Them in Investing

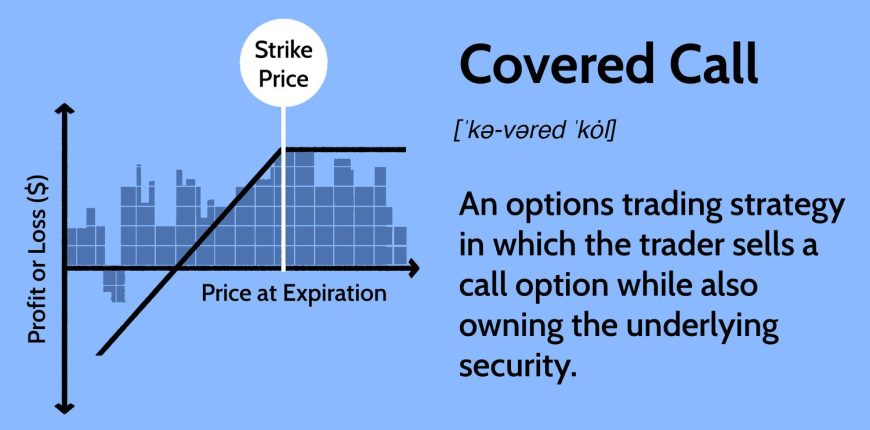

What Is a Covered Call?

A covered call is a sale of call options by a seller who owns shares in the underlying stock or other asset. The seller is creating an additional stream of income by collecting options premiums while continuing to hold onto the stock shares. At worst, the investor would have to hand over the shares if the options are exercised.

The covered call options strategy is generally used when the seller intends to own the shares for the long term but does not expect them to increase in value sharply before the option expires.

Key Takeaways

- An investor who sells a covered call expects only a minor increase or decrease in the underlying stock price for the life of the option.

- The investor wants to hold onto the…