Welcome to Sherwood’s deep dive into futures markets, presented in partnership with ![]()

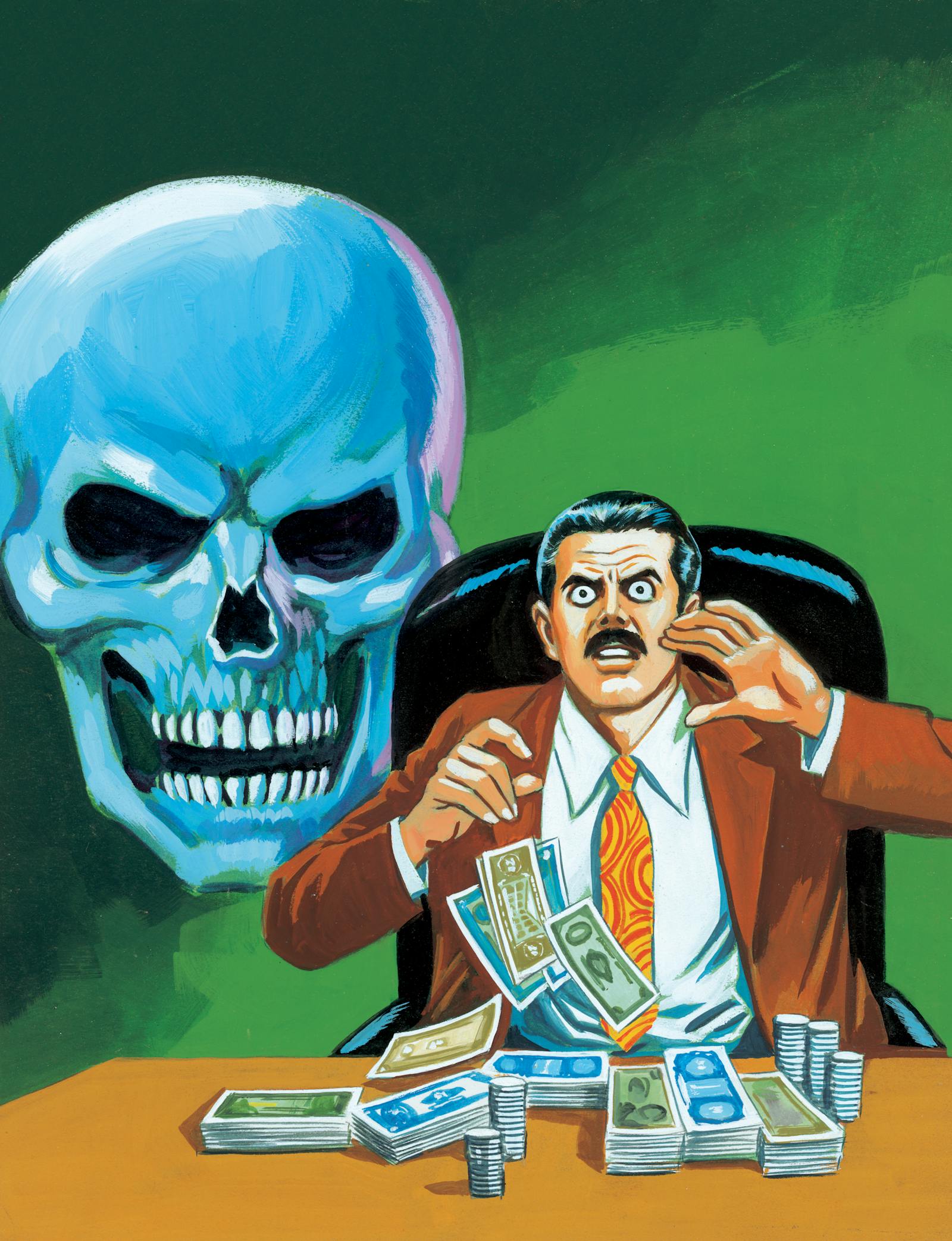

As anxiety over the AI trade increases and volatility in crypto spikes, traders who have a long-term bullish outlook on their holdings but have near-term concerns about downswings can use futures to manage risk.

Just as the origins of the futures market can be traced back to farmers who needed to hedge their crops, hedging is still an important function of the futures market for all types of participants, from airlines hedging the price of oil to retail investors looking to hedge their retirement portfolio.

Why hedge?

Hedging with futures allows traders to manage portfolio risk in the event of a downturn. As their holdings lose value, a short futures…