An obscure ETF tax perk for wealthy investors might soon get more attention.

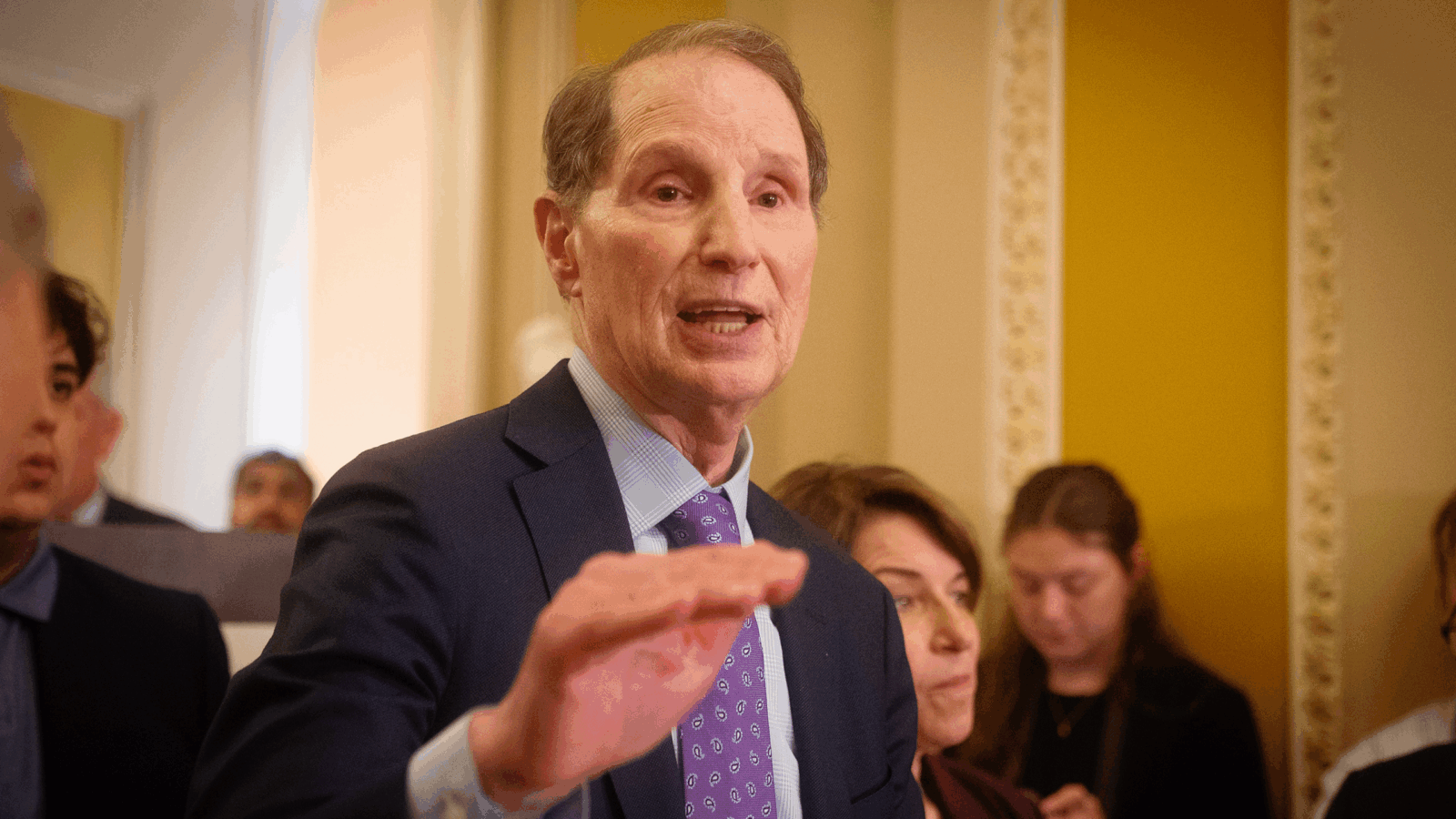

So-called 351 exchanges, which can allow stocks to be transferred into ETFs on a tax-deferred basis, are attracting scrutiny from Congress. At least one lawmaker has proposed a bill that would seek to limit 351s, which take their name from the relevant section of the US tax code. The strategy is somewhat new, and there are a handful of ETF issuers and RIAs that are focusing on seeding new exchange-traded funds with assets from separately managed accounts or big stock positions with untaxed gains. It’s unclear if the legislative package introduced earlier this month by Sen. Ron Wyden, D-Ore., has much support in the current Congress, but the sponsor is…