Data stability and PVAR regression results

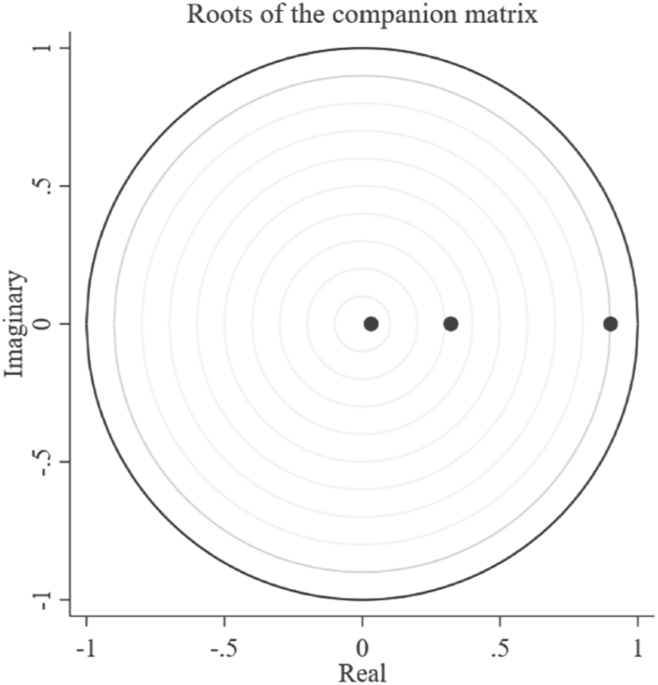

This paper proceeds to utilize Stata 17 software for processing and analyzing the Panel Vector Autoregression (PVAR) model. Before constructing the model, it is necessary to test the panel data for stability to avoid the issue of spurious regression. This paper employs two common methods for testing unit roots in panel data—the Augmented Dickey–Fuller test and the Phillips–Perron test, to examine the stability of the data. The results are presented in Table 4, with both tests having the null hypothesis that all variables have a unit root process (i.e., the data are non- stable).

Based on the data from Table 4, it is evident that all the statistics from…