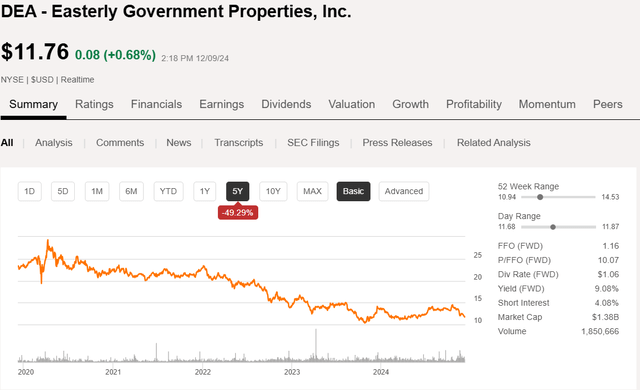

Easterly Government Properties, Inc. (NYSE:DEA) is contractually owed $3.389 billion of rent from the U.S. Government. It can be bought today at an enterprise value of $2.825 billion. That is a proposition that got us interested in the government lease REIT after a remarkable fall in its market price.

We believe that at today’s valuation, the risk/reward outlook is quite favorable.

This article will explore:

- Why DEA is trading so cheaply

- Sustainability of DEA’s 9% dividend yield

- Growth outlook

- Department of Government Efficiency (“DOGE”) risk.

How the stock got to this level

5 years ago, DEA was trading at 20X funds from operations, or FFO, and a stock price of in the mid-$20s. Today, it has fallen to $11.77, which is just a 10X…