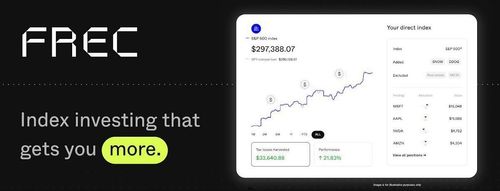

Direct Indexing: A Savvy Approach to Index Investing ��

“Frec’s fee structure is designed to democratize access to sophisticated tax-efficient investing strategies,” Jones states.

By charging as low as 0.10% annually, Frec positions itself competitively against traditional financial advisors and platforms, which often charge higher fees. For example, Wealthfront charges 0.25%, and traditional brokerages can charge even more, especially for personalized direct indexing services [1].

This lower fee structure can significantly impact investment growth over time. Consider two scenarios where an investor contributes $100,000 to a portfolio:

● With Frec’s 0.10% fee, the annual cost is just $100 per $100,000 invested. ● With a traditional advisor charging 1.0%, the cost is $1,000 annually per…