Wall Street and Silicon Valley are embroiled in a legislative slugfest over which business interests will get to fleece more of their customers’ money.

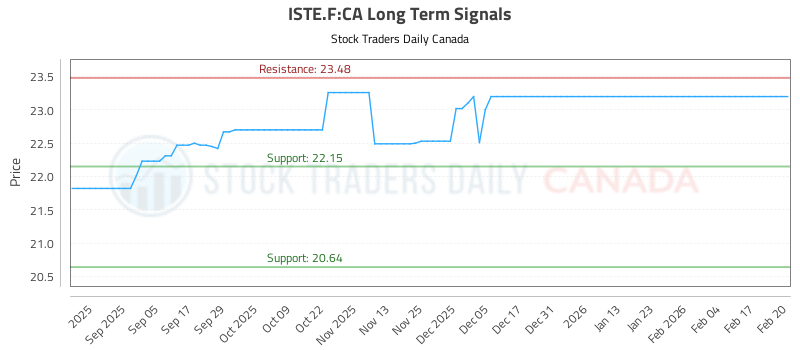

A loophole under current law allows stablecoins — crypto tokens pegged to the US dollar — to essentially pay interest on their investors’ holdings, similar to a bank account except without the same regulatory guardrails.

This carve-out could lure depositors away from banks’ savings accounts — a move that would threaten a multitrillion-dollar scheme by the banking industry in recent years, in which they’ve paid minuscule interest on customers’ financial deposits while enjoying far higher interest rates from the country’s central bank and pocketing the difference.

Now…