BoE Rate Cut and Motor Finance Risk in Focus

18 December 2025 — Lloyds Banking Group plc (LSE: LLOY, NYSE ADR: LYG) is back in the spotlight as investors weigh a pivotal UK macro moment against a stubborn company-specific overhang: the Bank of England’s expected interest-rate cut and the still-evolving motor finance redress bill.

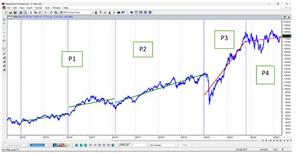

Lloyds shares traded around 95.5p on Thursday, with the session’s range clustered in the mid‑90s and the 52‑week range spanning roughly 52p to 98p. [1] That keeps the stock close to the upper end of its one‑year band after a strong 2025 run, while setting up what could be a decisive winter test: can capital returns and “structural hedge” income offset falling rates and regulatory uncertainty?

Below is what’s moving Lloyds today, what…