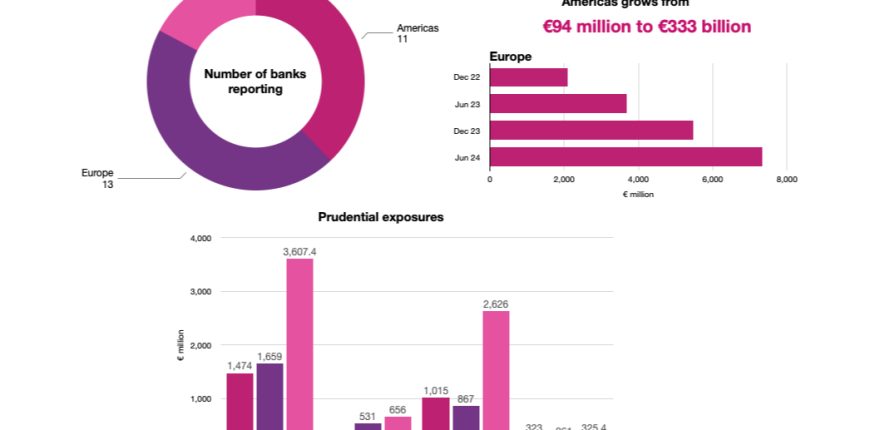

The Basel Committee on Banking Supervision has published Basel III monitoring statistics for June 2024, including digital asset exposures. Statistics for US banks showed massive swings from previous periods. Although US banks continue to hold very few cryptocurrencies on their balance sheet, in late 2023 they provided significant services to clients to the tune of €190 billion ($205 billion). However, by June 2024 the client figure had collapsed to under €5.8 billion.

This may be consistent with the many letters sent by the FDIC to banks discouraging them from engaging with crypto-assets, including blocking them from providing client access.

There’s one important…