Axiata Group Berhad’s (KLSE:AXIATA) Share Price Is Matching Sentiment Around Its Revenues

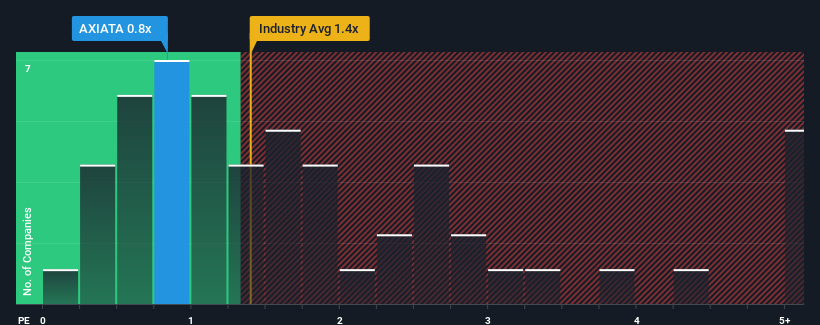

Axiata Group Berhad’s (KLSE:AXIATA) price-to-sales (or “P/S”) ratio of 0.8x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Wireless Telecom industry in Malaysia have P/S ratios greater than 2.4x. Although, it’s not wise to just take the P/S at face value as there may be an explanation why it’s limited.

We’ve discovered 2 warning signs about Axiata Group Berhad. View them for free.

Check out our latest analysis for Axiata Group Berhad

What Does Axiata Group Berhad’s Recent Performance Look Like?

There hasn’t been much to differentiate Axiata Group Berhad’s and the industry’s revenue growth lately. It might…