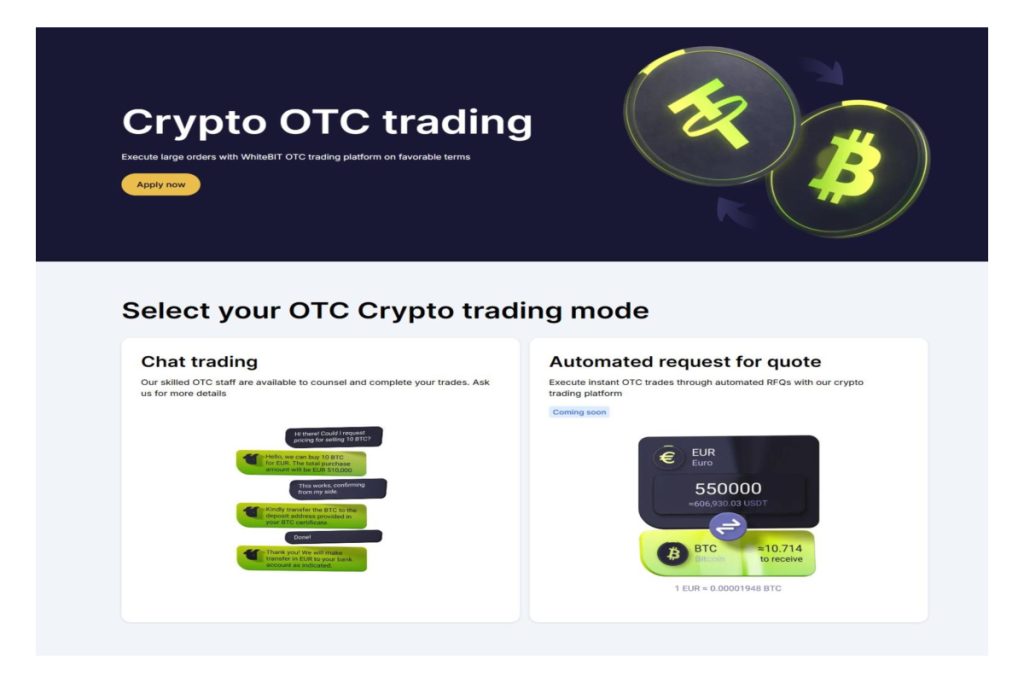

As institutional participation in digital assets continues to grow, many professional traders are turning to a reliable crypto otc trading platform to execute large transactions without disrupting public markets. In 2026, private deal desks have become a core component of institutional trading strategies, offering discretion, tailored execution, and predictable pricing for sizable orders.

Unlike traditional exchange-based trading, OTC (Over-The-Counter) execution allows counterparties to negotiate trades directly, often with the support of a dedicated desk. This model is especially attractive to funds, corporate treasuries, and high-net-worth participants who need certainty and control when entering or exiting significant…