Senseonics Holdings, Inc.’s (NASDAQ:SENS) Share Price Could Signal Some Risk

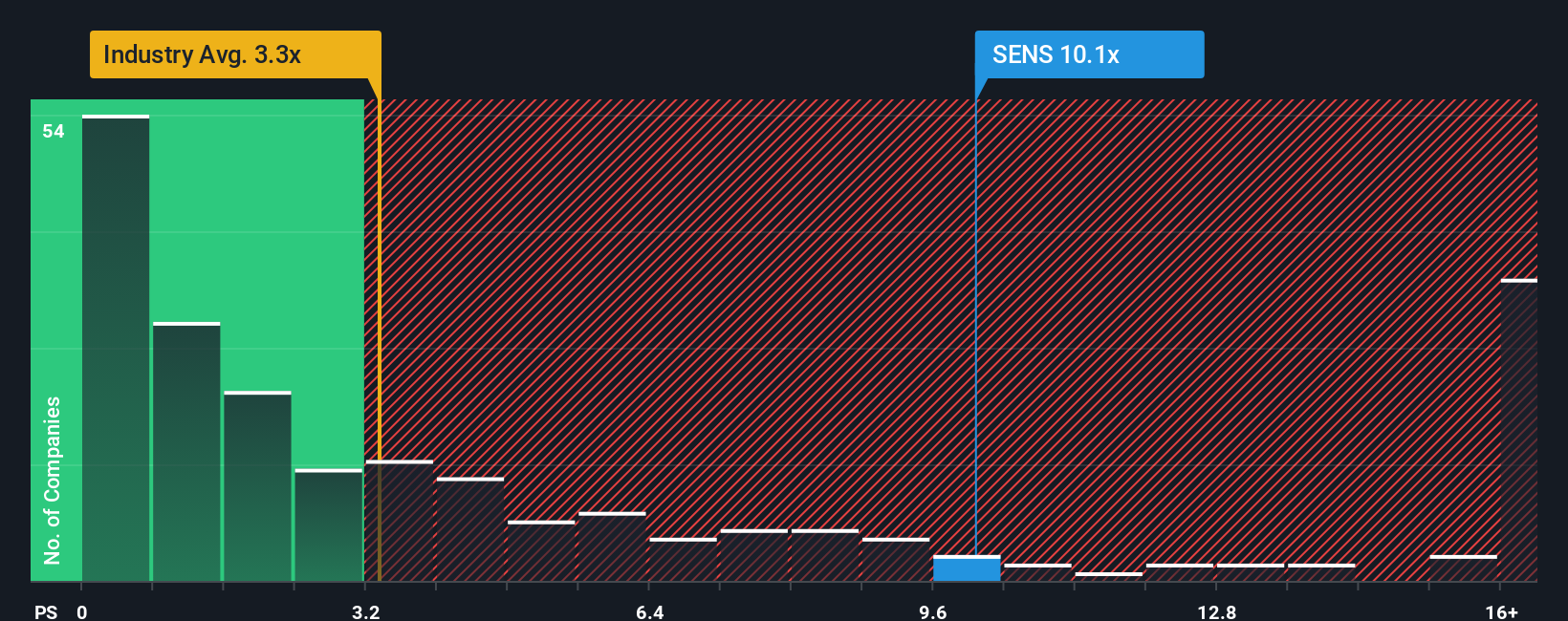

You may think that with a price-to-sales (or “P/S”) ratio of 9.9x Senseonics Holdings, Inc. (NASDAQ:SENS) is a stock to avoid completely, seeing as almost half of all the Medical Equipment companies in the United States have P/S ratios under 3.3x and even P/S lower than 1.2x aren’t out of the ordinary. Although, it’s not wise to just take the P/S at face value as there may be an explanation why it’s so lofty.

See our latest analysis for Senseonics Holdings

How Senseonics Holdings Has Been Performing

With revenue growth that’s superior to most other…