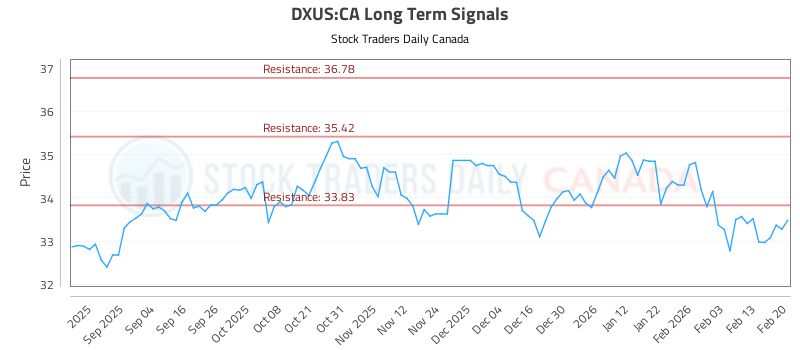

Cash reserves in cryptocurrency can be a matter of life and death. As the market remains unpredictable, where you park your liquid assets becomes crucial. The strategies adopted by crypto firms can draw valuable insights from traditional stalwarts like Berkshire Hathaway. Here, we’ll explore the best practices for managing cash reserves that may position your business for success in this volatile world.

Cash Reserves: A Defensive Measure

For crypto firms, a hefty cash reserve signals caution. It’s essentially a cushion against unforeseen events—like the need to pay dividends or service debts—without necessitating the sale of Bitcoin. Take MicroStrategy, for instance, which boasted a cash reserve of $2.19 billion by late 2025,…