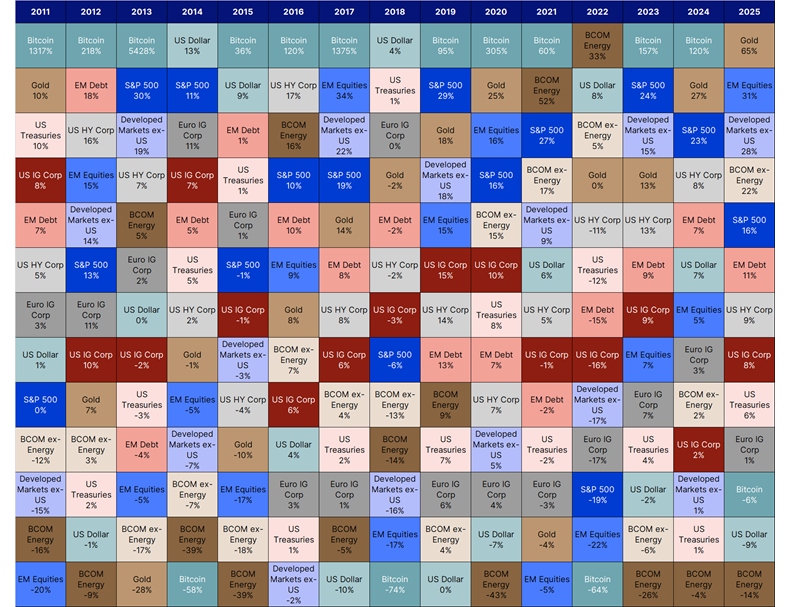

Key points:

- Diversification was rewarded in 2025: gold led, non-US equities outperformed the S&P 500, and broad commodities ex-energy did well.

- The expected leaders didn’t repeat: bitcoin cooled, the US dollar weakened, and energy lagged despite broader commodity strength.

- The main takeaway isn’t forecasting—it’s portfolio design: rebalance with discipline, diversify across different return drivers, and run “what if” checks into 2026.

2025 in one glance

2025 delivered a clear message: market leadership can shift quickly, and portfolios need to be prepared for that.

Source: Saxo

If you have trouble viewing the above table, click here: Cross Asset Returns Over the Last 15 Years

- Big winner: Gold +65% — the standout of the…