Here’s a top broker’s view on the latest CBA share price

Image source: Getty Images

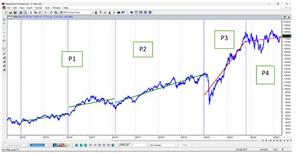

The Commonwealth Bank of Australia (ASX: CBA) share price has been a very pleasing investment, rising by roughly 150% over the last five years (at the time of writing).

Some investors have questioned whether the bank’s valuation is worth it, considering it operates in the same industry as other banks, like Westpac Banking Corp (ASX: WBC), National Australia Bank Ltd (ASX: NAB), and ANZ Group Holdings Ltd (ASX: ANZ), which have lower valuations.

CBA has some aspects going for it, including a relatively strong net interest margin (NIM), a pleasing return on equity (ROE), impressive proprietary channels to attract new loans, and a resilient dividend.

But the bank has a new focus recently: efficiencies…