Solana Gains Traction Among Public Company Crypto Holdings

Public companies are increasingly adding Solana to their balance sheets, following Bitcoin and Ethereum’s adoption trends.

Digital asset treasuries (DATs) let firms list on stock markets, purchase crypto, and grow token holdings per share, giving investors exposure without directly buying coins. Unlike ETFs, DATs can actively deploy assets – staking, running validators, and using DeFi strategies — even in flat markets.

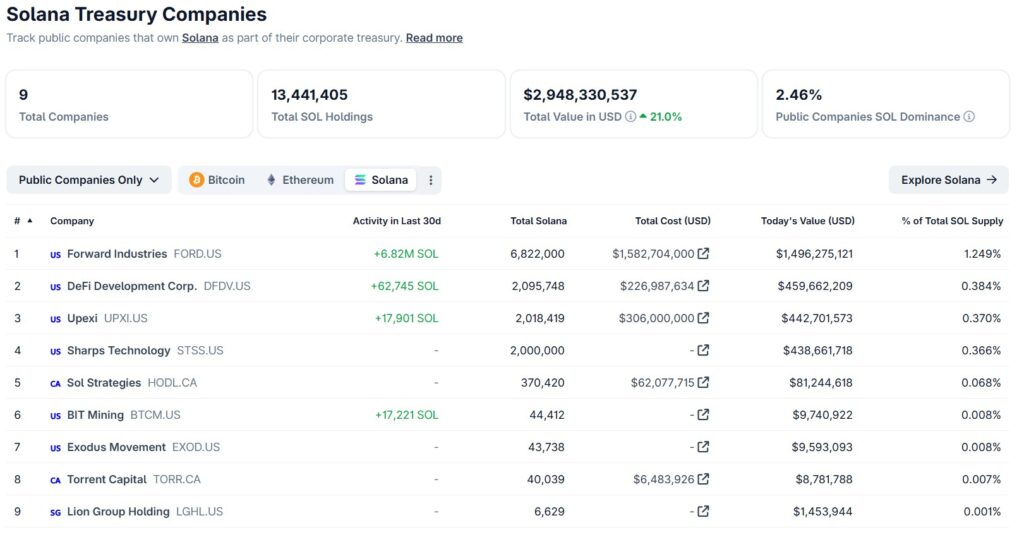

Over the past month, corporate treasuries accumulated about 6.3 million SOL (over 1.6% of circulating supply), led by Forward Industries, DFDV, Upexi, and Sharps Technology. Together, Solana treasuries now hold 2.46% of SOL, worth nearly $3 billion.

Solana’s high-throughput, low-fee blockchain…