Traders pay steeper price to hedge risk from stocks to gold

Stock image.

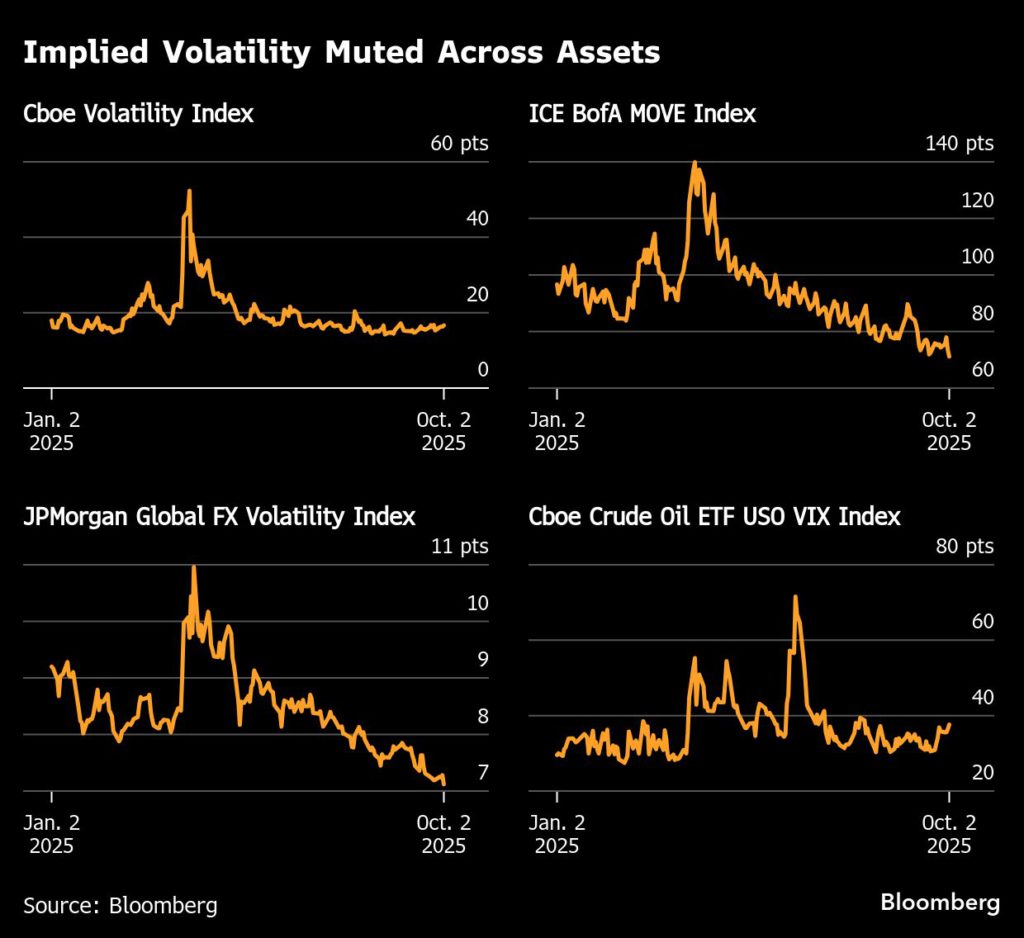

The risk premium for options is rising in assets from stocks to gold, even as implied volatility on benchmark indexes has been either steady or falling for most of this year.

While that may seem counterintuitive, it’s in large part because the actual market swings have been so lackluster. That’s boosting the risk premium, or difference between how much traders expect a market to move and how much it has moved.

The narrow ranges — and rising risk premium — can be pinned on different factors depending on the market. Rate-cut expectations are driving gold, supply and demand outlooks are hemming in oil and uncertainty around the Federal Reserve, corporate earnings and retail flows are…