The Implications of New York’s Proposed 0.2% Crypto Tax on Stablecoins and Digital Asset Liquidity

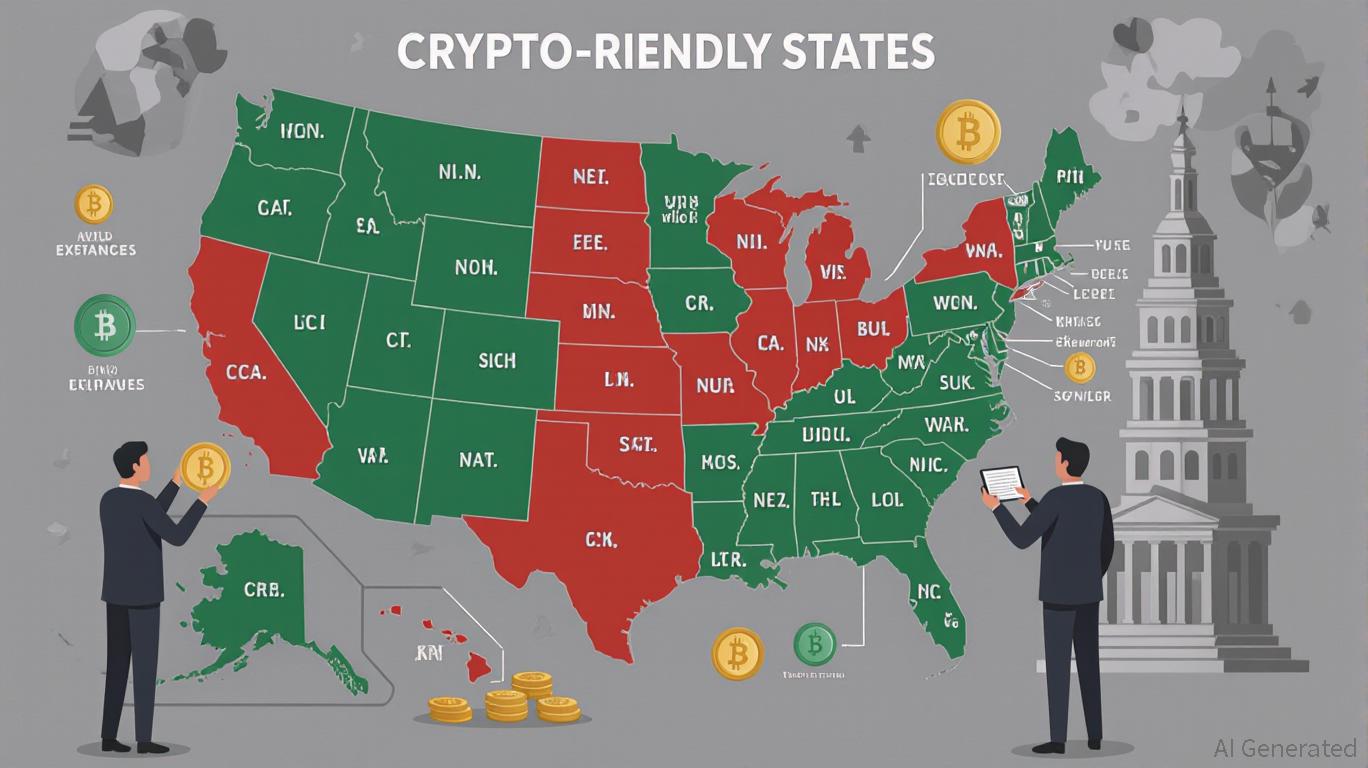

New York’s proposed 0.2% excise tax on cryptocurrency transactions, including stablecoins, has ignited a heated debate about the future of digital asset markets in the U.S. Assembly Bill A0966, introduced by Phil Steck, aims to generate $158 million annually for upstate school substance abuse programs. While the tax is framed as a modest levy, its implications for liquidity, regulatory arbitrage, and the role of stablecoins in mainstream finance are profound. For investors, the tax underscores the growing fragmentation of the U.S. crypto landscape and the urgent need to adapt to a patchwork of state-level policies.

Regulatory Risk and Market Behavior Shifts

The 0.2% tax, if enacted, will directly impact high-frequency traders and…