Crypto Market Pullback Wipes Out $1B in Leverage, But Analysts See Healthy Correction

A sharp drop in Bitcoin and other digital assets on Thursday triggered more than $1 billion in leveraged position liquidations, marking the largest single-day flush of long bets since early August. Despite the scale of the sell-off, market strategists say the move represents a normal cooling-off after a record-setting rally rather than the start of a broader reversal.

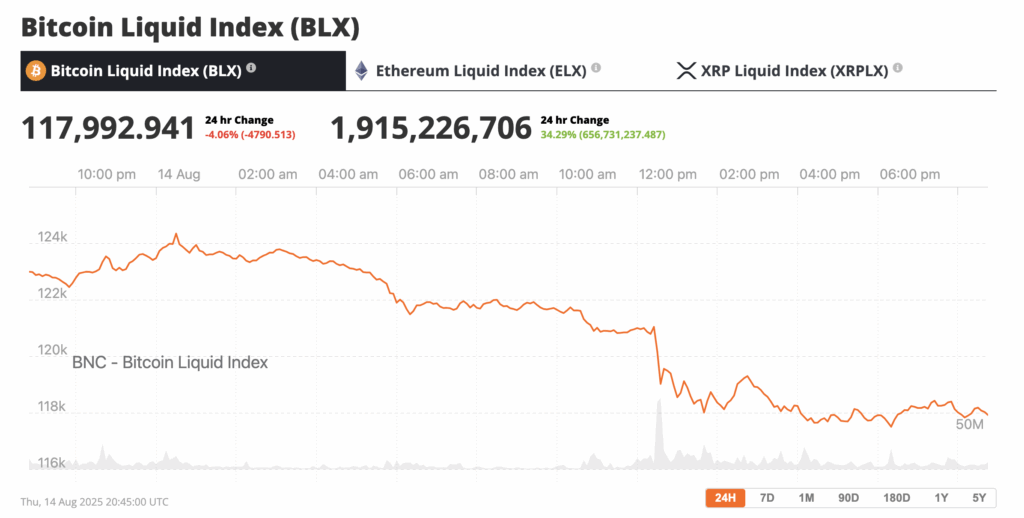

Bitcoin (BTC) fell 2.3% over the past 24 hours to about $118,000 after hitting an all-time high above $124,000 overnight.

Bitcoin dropped to just under $118,000, source: Bitcoin Liquid Index

The pullback followed hotter-than-expected U.S. Producer Price Index (PPI) data for July, which showed a 3.3% annual rise in wholesale prices. The report dented expectations for…