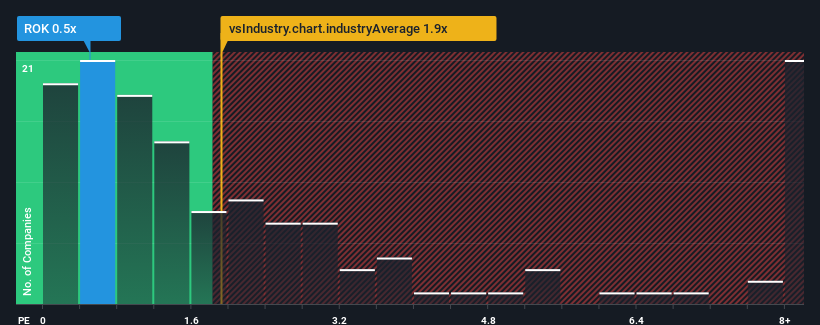

With a price-to-sales (or “P/S”) ratio of 0.5x ROK Resources Inc. (CVE:ROK) may be sending bullish signals at the moment, given that almost half of all the Oil and Gas companies in Canada have P/S ratios greater than 1.9x and even P/S higher than 6x are not unusual. Nonetheless, we’d need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

We’ve discovered 3 warning signs about ROK Resources. View them for free.

Check out our latest analysis for ROK Resources

How ROK Resources Has Been Performing

Recent times haven’t been great for ROK Resources as its revenue has been rising slower than most other companies. The P/S ratio is probably low…