Insufficient Growth At ITM Semiconductor Co., Ltd. (KOSDAQ:084850) Hampers Share Price

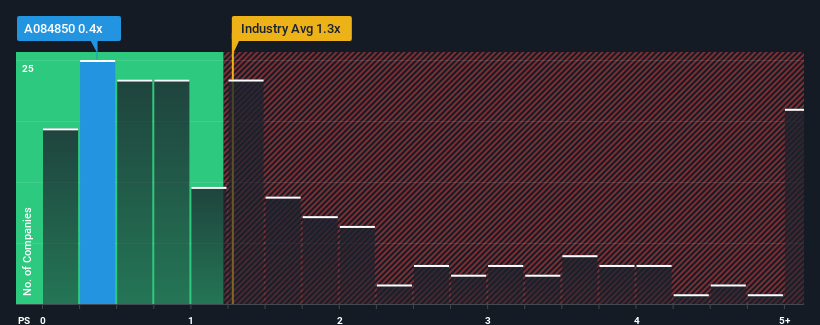

ITM Semiconductor Co., Ltd.’s (KOSDAQ:084850) price-to-sales (or “P/S”) ratio of 0.4x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Semiconductor industry in Korea have P/S ratios greater than 1.3x. However, the P/S might be low for a reason and it requires further investigation to determine if it’s justified.

View our latest analysis for ITM Semiconductor

What Does ITM Semiconductor’s P/S Mean For Shareholders?

ITM Semiconductor could be doing better as it’s been growing revenue less…