The Price Is Right For Revu Corporation (KOSDAQ:443250)

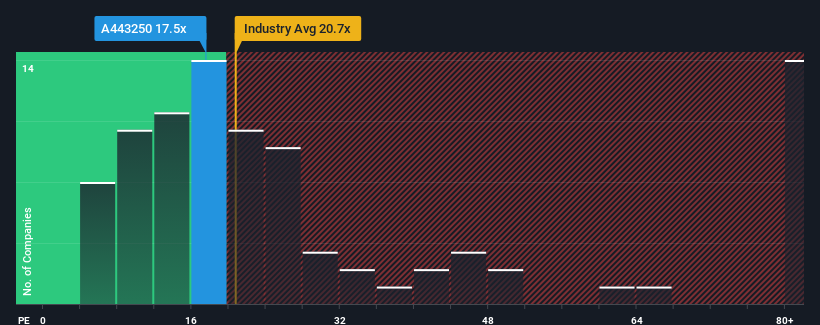

When close to half the companies in Korea have price-to-earnings ratios (or “P/E’s”) below 11x, you may consider Revu Corporation (KOSDAQ:443250) as a stock to potentially avoid with its 17.5x P/E ratio. Nonetheless, we’d need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

We’ve discovered 1 warning sign about Revu. View them for free.

Recent times have been advantageous for Revu as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Revu