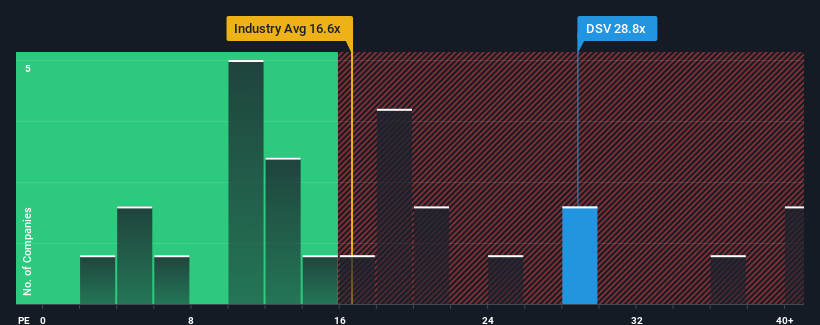

When close to half the companies in Denmark have price-to-earnings ratios (or “P/E’s”) below 15x, you may consider DSV A/S (CPH:DSV) as a stock to avoid entirely with its 28.8x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it’s justified.

DSV hasn’t been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You’d really hope so, otherwise you’re paying a pretty hefty price for no particular reason.

See our latest analysis for DSV